The National Tax Number (NTN), issued by the Federal Board of Revenue (FBR) in Pakistan, is a unique identifier for individuals and businesses to ensure proper taxation. The validity of an NTN can be checked online using a Computerized National Identity Card (CNIC). The verification process involves going to the FBR website, selecting the “Online NTN/STRN Inquiry” option, entering the CNIC number, selecting the relevant tax year, and submitting the request. The system then displays the NTN number and other pertinent details. This convenient method eliminates the need for in-person visits to FBR offices and reinforces the integrity of the tax system.

Online NTN Verification FBR by CNIC Pakistan Login

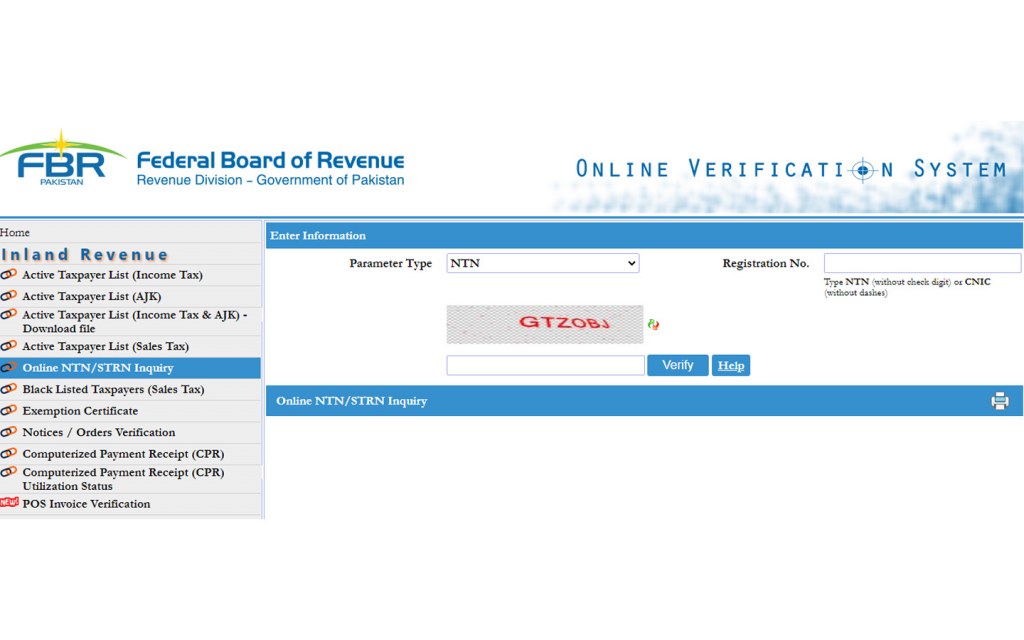

To perform online NTN verification by CNIC in Pakistan, you need to log in to the Federal Board of Revenue (FBR) website. Follow these steps:

- Visit the FBR website (www.fbr.gov.pk).

- Look for the “Online NTN/STRN Inquiry” option on the website.

- Click on the option to proceed.

- You will be prompted to log in using your CNIC and password.

- Enter your CNIC number and password in the respective fields.

- After successful login, you will be able to access the online NTN verification portal.

- Enter the relevant tax year for which you want to verify your NTN.

- The system will display your NTN number and other related information, such as your name and address.

By following these steps, you can easily log in to the FBR website and perform online NTN verification using your CNIC in Pakistan.

FBR NTN Verification by CNIC

You can verify your FBR NTN (National Tax Number) online using your CNIC (Computerized National Identity Card) number. Simply follow these steps:

- Visit the official FBR website.

- Look for the NTN verification option.

- Enter your CNIC number in the provided field.

- Click on the “Verify” or “Check” button.

This will allow you to confirm your NTN online, ensuring that your tax matters are in order by CNIC

The Federal Board of Revenue’s (FBR) Online NTN Verification method through CNIC in Pakistan is a game-changer for taxpayers. It gives you a quick and easy way to check your National Tax Number, so you don’t have to waste time going to tax centers. This digital effort makes the tax process more accurate and clear, making it easy for people and businesses to check their tax compliance status online. It’s a big step toward making Pakistan’s tax system more efficient and easy to use, which will make users’ lives much easier.

Online NTN Verification FBR By CNIC

By choosing CNIC and NTN in the box for parameters and then entering the CNIC Number and National Tax Number in the “Registration No.” box, without dashes, you can test the authenticity of your taxpayer profile. After you have entered the verification number hit”Verify” to confirm the information “Verify” button to get the following details:

- Registration No

- Reference Number

- Licensed to Collect Sales Tax

- Name

- Category

- No. PP/REG/INC

- Cell

- Address

- Registered With

- Fiscal Office

- Application Status

Online NTN Verification FBR By CNIC Pakistan | Active TaxPayer Status

What is NTN Verification?

NTN verification is a process that helps verify the authenticity of the National Tax Number issued by the FBR. The FBR has made it mandatory for all taxpayers in Pakistan to have an NTN, and it is used to track the tax-related activities of individuals and businesses. The verification process helps ensure that the NTN is valid and belongs to the individual or business that is claiming it.

NTN Verification Importance

NTN verification is important because it helps prevent tax fraud and ensures that taxpayers are paying the correct amount of taxes. By verifying the NTN, the FBR can track the tax-related activities of individuals and businesses and take appropriate action if any discrepancies are found.

Types of NTN

There are three kinds of NTN available online.

- Personal NTN. FBR issues this kind of NTN to the CNIC of the person using the web-based NTN verification system. FBR issues or registers it for salaried or business persons.

- Association of People (AOP) or Partnership The type of online NTN is available to individuals who are affiliated with one another. Affiliation of people is the association between partners of at minimum two. It is affixed to the certificate of registration issued by the AOP.

- The company’s NTN Company’s NTN: This kind of digital NTN will be given to the firm. The NTN is accredited to registration certificates that are issued by FBR Securities and are then verified by FBR’s web-based NTN Verification System.

How to Verify NTN Online?

The process of verifying NTN online is simple and can be done using your CNIC number. Here’s how you can do it:

- Visit the FBR’s online verification portal

- Click on the Online NTN/STRN Inquiry option.

- Enter your CNIC number in the NTN/STRN field.

- Enter the captcha code displayed on the screen.

- Click on the Search button.

- If the NTN associated with your CNIC is valid, it will be displayed on the screen along with other relevant details.

FBR Filer Status Check Online in Pakistan 2024

To check FBR filer status online in Pakistan, you can use the following methods:

Online Verification Services

- You can verify your details with the Federal Board of Revenue (FBR) using their Online Verification Services1

- Visit the FBR website’s Online Verification Services page

- And choose the desired service from the left panel to proceed with the verification process.

Active Taxpayer List (ATL)

- You can check your individual’s Active Taxpayer status by sending an SMS with the format “ATL (space) 13 digits Computerized National Identity Card (CNIC)” to 99662

- For AOP and Company, send an SMS with the format “ATL (space) 7 digits National Tax Number (NTN)” to 99662

- For AJ&K Active Taxpayer, send an SMS with the format “AJKATL (space) CNIC (without dashes)” to 9966 for individuals, or “AJKATL (space) 11 digit NTN (without dashes)” to 9966 for companies

Active Taxpayer List (ST)

- You can also check your Active Taxpayer status (ST) through the online portal provided by the FBR3

- Visit the FBR website’s Active Taxpayer List (ST) page

- and follow the instructions to verify your status.

Please note that the Active Taxpayer List (ATL) is a central record of online Income Tax Return filers for the previous tax year, published annually on the 1st of January 2024. The ATL is updated every Monday on the FBR website

Benefits of Online NTN Verification

There are several benefits of verifying NTN online, including:

- Convenience: The online verification process is quick and convenient, allowing taxpayers to verify their NTN from the comfort of their homes.

- Accuracy: Online verification helps ensure that the NTN is valid and belongs to the individual or business claiming it, preventing tax fraud.

- Transparency: The online verification process is transparent, and taxpayers can access the details of their NTN and related tax information.

FAQs

Can I verify my NTN using someone else’s CNIC number?

No, you can only verify your NTN using your own CNIC number.

What should I do if my NTN is invalid?

If your NTN is invalid, you should contact the FBR to resolve the issue.

Is there a fee for online NTN verification?

No, there is no fee for online NTN verification.

How long does it take to verify NTN online?

The online verification process is quick, and the results are displayed instantly.

Can I verify someone else’s NTN using my CNIC number?

No, you can only verify your own NTN using your CNIC number.

Summary

Verifying your NTN online is a simple process that helps ensure that your tax-related activities are in order. The FBR has made it mandatory for all taxpayers in Pakistan to have an NTN, and online verification helps prevent tax fraud and ensures that taxpayers are paying the correct amount of taxes. We hope this article has helped you understand the process of online NTN verification by FBR using CNIC in Pakistan.