The Prime Minister of Pakistan, Shehbaz Sharif, has launched a program called the PM Youth Loan Scheme 2024. This program is designed to help young people in Pakistan start their own businesses. The government will provide financial assistance in the form of loans to individuals between the ages of 21 and 45 who have innovative business ideas but lack the necessary funds. The loans will range from PKR 100,000 to PKR 2 million and will be offered by various banks at low-interest rates and with flexible repayment options. This initiative aims to support the youth and promote entrepreneurship in the country. This program partners with over 15 banks, including Commercial, Islamic, and SME banks, to offer low-interest loans with easy installment plans to the youth.

The PM Youth Loan Scheme 2024 is a great opportunity for young people to get the funding they need to start their businesses. If you are a young person with a creative business idea, I encourage you to apply for a loan under this program.

PM Youth Loan Scheme 2024 New Updates

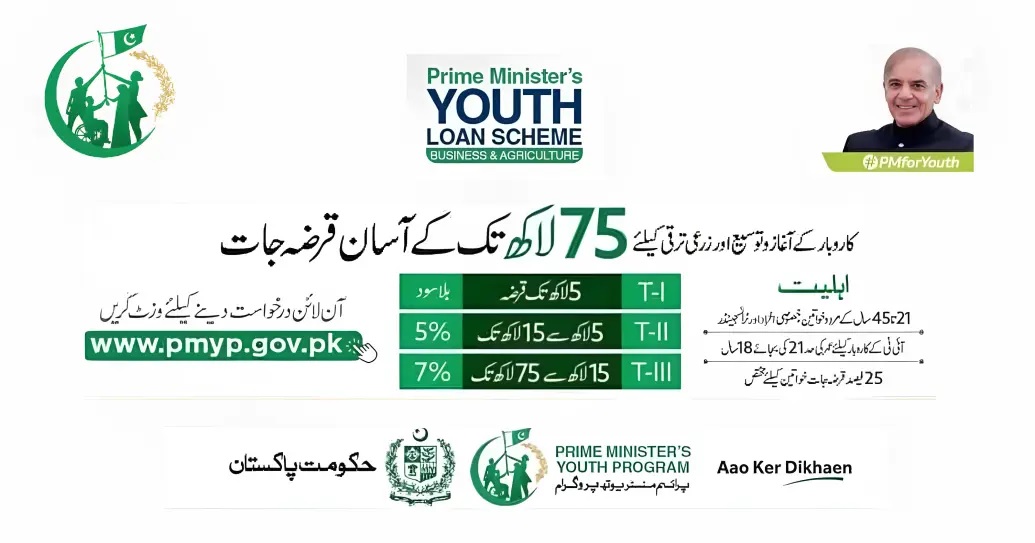

Prime Minister Shahbaz Sharif of Pakistan has recently launched a loan scheme to support young entrepreneurs in their businesses and agriculture. The aim of this program is to create more job opportunities within the country and reduce unemployment. Under this scheme, all Pakistanis between the ages of 21 and 45 can apply for loans of up to 75 Lac (7.5 million) at low-interest rates. This financial assistance will help them expand their businesses and achieve their goals. The loan scheme is divided into three tiers, and the interest rates vary depending on the loan amount. This initiative provides different options for individuals to access government loans and start or grow their businesses.

List of Banks Who Provide PM Youth Loans;

| No. | Bank Name |

|---|---|

| 1 | Bank Alfalah Islamic |

| 2 | Askari Islamic Banking |

| 3 | Bank of Khyber Raast Islamic Banking |

| 4 | Zarai Taraqiati Bank Limited |

| 5 | United Bank Limited |

| 6 | Meezan Bank Limited |

| 7 | MCB Bank Limited |

| 8 | Habib Bank Limited |

| 9 | First Woman Bank Limited |

| 10 | Bank Islamic Pakistan Limited |

| 11 | Bank Al Habib |

| 12 | Bank Al Falah |

| 13 | Askari Bank Limited |

| 14 | Allied Bank Limited |

| 15 | Bank of Khyber |

| 16 | Bank of Punjab |

| 17 | National Bank of Pakistan |

PM Youth Loan Scheme 2024 Online Registration | pmyp.gov.pk Application Form

Rime Minister’s Youth Business Loans

The borrower is advised to negotiate conditions prior to closing the loan with the lender. The program provides an initial grace period of one year. The length of the grace period is contingent on the nature of the business and the banks’ decisions. The borrower should negotiate the terms before closing the loan with the bank. PM’s Youth Business Loan Scheme has assisted entrepreneurs across the country to increase their profits. Up to date, over 1.5 billion rupees of Agriculture sector loans are being disbursed to farmers in the industry of agriculture. Apply online prior to the deadline for approval of the loan amount you want.

پاکستانی حکومت نے نوجوانوں کو اپنا کاروبار شروع کرنے میں مدد کرنے کے لیے پی ایم یوتھ لون اسکیم کے نام سے ایک نیا پروگرام شروع کیا ہے۔ یہ پروگرام 21 سے 45 سال کی عمر کے نوجوانوں کو پیسے دینے کا ارادہ رکھتا ہے، جن کے پاس تخلیقی کمپنی کے خیالات ہیں لیکن انہیں حقیقت بنانے کے لیے وسائل کی کمی ہے۔ اہل افراد پی ایم یوتھ لون سکیم 2024 کے تحت 100,000 سے لاکھ تک کے پی ایم یوتھ بزنس لون اسکیم نے ملک بھر کے تاجروں اور ان کے کاروبار کو بڑھانے میں مدد کی ہے۔ اب تک زرعی شعبے میں 1.5 ارب روپے سے زائد کے قرضے زرعی صنعت میں تقسیم کیے جا چکے ہیں۔ اپنی مطلوبہ قرض کی رقم کی منظوری کے لیے آخری تاریخ سے پہلے تیزی سے آن لائن درخواست دیں۔قرض کے لیے درخواست دے سکتے

Eligibility Criteria For PM Youth Loan Scheme

Applicants for loans through the Prime Minister Youth Loan Program 2024 are required to:

- Candidates must be males or women with CNICs, be between the ages of 21 and 45, and have the capacity to succeed in business. For businesses involved in IT or e-commerce, the minimum age requirement is 18.

- According to the SBP, small and medium-sized businesses (both startup and established businesses) are eligible.

- For IT/E-Commerce-related businesses, matriculation or an equivalent level of education will be required at the very least.

- Both new and established micro- and small-business businesses are eligible under this program.

- The program’s minimum age requirement is 21, with a grace period of up to 18 years.

- The age restriction is 45 as of the application’s submission. At least one partner or director of the company must be within the program’s age restrictions (21-45 years).

- There is no set standard for a minimum level of education, yet it will be a favorable element in banks’ decision-making.

- There is no discrimination against women in this program, although a total of 25% of all loans are set aside for them.

- Applicants who have private employment options are also welcome.

- The current micro and small companies can benefit from this scheme as well.

- One application per name, one family member only.

- The only people who can apply for this program are Pakistanis.

- No one is permitted to get more than one loan.

- The program does not let blood relatives of participating bank employees qualify for loans under this initiative from these banks.

- No applications from government personnel are accepted for this program.

- All businesses that operate ethically and legally are eligible for this program.

- The companies that applicants choose should be morally and legally righteous, commercially successful, applicable to their specific professions, and for which they have the basic minimum of education, training, experience, knowledge, and support.

PM Youth Loan Online Application Form

Documents Required for PM Youth Loan Scheme

The following documents are required to apply for the PM Youth Loan Scheme 2024:

- National ID Card: A copy of the individual’s National ID Card is required to verify their citizenship and age.

- Educational Qualification: A copy of the individual’s educational qualification, such as a certificate or diploma, is required to verify their minimum educational qualification.

- Business Plan: A detailed business plan that outlines the individual’s business idea, financial projections, and growth plan is required to assess the viability of the business.

- Proof of Income: The individual must provide proof of their income to ensure that they can repay the loan. This can include pay slips, bank statements, or tax returns.

- Financial Statements: The individual must provide financial statements, such as a balance sheet and income statement, to demonstrate the financial health of their business.

- Collateral: In some cases, the individual may need to provide collateral, such as property or other assets, to secure the loan.

Prime Minister Youth Business Loan 2024 Tiers Details

- Tier-1: The range is 100,000 – 1,000,000 PKR, with a 3% markup. This tier does not require security.

- Tier-2: The range is between 1 million and 10,000,000 PKR, with a 4% markup.

- Tier-3 This range includes more than 10 million up to 25,000,000 PKR, with a 5% markup.

Bank Names

- Meezan Bank Limited

- Allied Bank Limited

- Bank Al Falah

- Habib Metropolitan Bank Limited

- MCB Islamic Bank Limited

- Albaraka Bank Limited

- Askari Bank Limited

- Dubai Islamic Bank Limited

- JS Bank Limited

- Sindh Bank Limited

- Bank Al Habib

- Bank Islamic Pakistan Limited

- Bank of Khyber

- Bank of Punjab

- Faysal Bank Limited

- First Woman Bank Limited

- Habib Bank Limited

- Soneri Bank Limited

- United Bank Limited

- MCB Bank Limited

- National Bank of Pakistan

Installments or Repayment of PM Business Loan 2024

- The loan is repaid in equal monthly or quarterly, bi-annually, or annual installments. The specific repayment timeframe will be contingent on the particular type of business and the bank’s choice. The borrower is advised to discuss these terms prior to closing the loan to the institution.

- The scheme allows for a one-year grace period. However, the precise grace period will depend on the particular business type and banks’ decisions. The lender is encouraged to discuss these terms prior to the date when the loan is finalized to the institution.

- The applicants can opt to make early payments during the loan term which will reduce the amount they owe in the principal.

- The limit is not set to the number of balloon payments.

- A borrower may make balloon payments only when the loan is regularly paid and there aren’t any outstanding installments.

- A person who is making balloon payments has the option to cut down on the loan payment period or reduce the amount of installment, or choose the combination of both these alternatives.

- A borrower is able to repay his loan completely at any time before the loan’s expiration date.

Summary

In conclusion, the PM Youth Loan Scheme 2024 is an important effort that will give young Pakistani businesses financial and technical support. The program’s goal is to assist young people in implementing their entrepreneurial ideas and boosting Pakistan’s economy. Take advantage of this chance to apply for the PM Youth Loan Scheme 2024 if you are a young entrepreneur with a creative company idea.

FAQs

What is the PM Youth Loan Scheme?

The Prime Minister Youth Loan Scheme (PMYLS) is a government-funded program that offers loans to young entrepreneurs to start or expand their businesses. The scheme is designed to help young people create jobs and contribute to the economic development of Pakistan.

Who is eligible for the PM Youth Loan Scheme?

To be eligible for the PMYLS, applicants must meet the following criteria:

- Be a Pakistani citizen

- Be between the ages of 18 and 45

- Have a valid CNIC

- Have a business plan

- Provide collateral of at least 20% of the loan amount

How much can I borrow under the PM Youth Loan Scheme?

The maximum loan amount that can be borrowed under the PMYLS is Rs. 5 million. The loan amount will be determined based on the applicant’s business plan and the collateral that is offered.

What are the interest rates and repayment terms for the PM Youth Loan Scheme?

The interest rate for the PMYLS is 6%. The repayment term is 5 years, and the loan can be repaid in monthly installments.