NBP Advance Salary Loan Scheme 2024 We’ve given you information regarding the latest National Bank NBP advance salary loan request form to be used in 2024, as well as an installment calculator as well as the percentage interest markup. We also provide details about the conditions and terms that apply to the scheme. National Bank of Pakistan advance loan scheme 2024 is an option for those employed by the government. The National Bank of Pakistan Loan Scheme is a fantastic option for service and regular workers who want to take advantage of cash advances. It is one of the most prestigious banks that is a public institution in Pakistan and provides a variety of loans to NBP accounts, Federal employees, semi-government workers, and members of the Armed Forces.

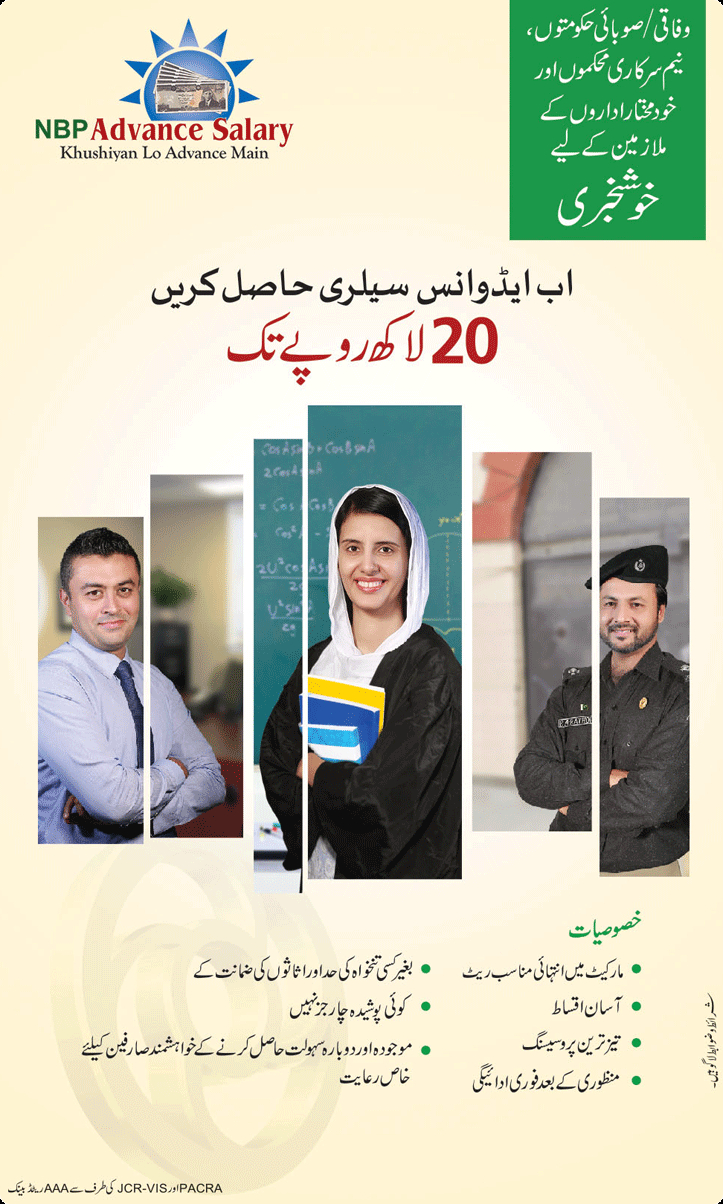

NBP Advance Salary Loan Advertisement 2024

Dear readers, you are able to download the NBP 2024 Advance Salary Loan Scheme application form from the official web page of NBP, and on the other side, you will be able to access the form by standing in front of “applykar.pk”. You will need to staple two CNIC copies as well as the salary sheet together with this form. You can complete the form at the nearest NBP branch.

NBP Advance Salary Loan Scheme 2024 Eligibility Criteria

The full details on how to utilize to use the National Bank of Pakistan NBP advance salary loan scheme for 2024 form, which allows you to apply the calculator to calculate interest on installments are provided here. The NBP’s permanent employees will be delighted to know about the advanced salary loan 2024 program will be put into operation. All federal government officials are involved in the process of implementing the program. Check the comments section to get any details.

Documents Required For NBP Salary Loan 2024

- Three months’ pay slips/pay slips or certificates.

- Request for rollover by the customer (Just in the event of a rollover).

- You need to supply 5 post-dated crossed cheques to the National Bank of Pakistan covering the total amount of the loan.

- You need to submit copies of the Computerized National Identity Cards of the borrower and two references (duly certified by the concerned National Bank of Pakistan branch or any officer who is a gazetted official) in the application form.

- You might be required to provide copies of your ID cards as well as references. Identity cards should be endorsed by an NBP branch or GAZETTED Officer).

- You’ll be required to sign an undertaking on stamp paper weighing 20 rupees.

- Its also mandatory to provide CF1 undertaking (Details of various facilities/loans/Credit cards etc taken from other banks including the National Bank of Pakistan)

NBP Advance Salary Loan Scheme 2024 For Government Employees

Terms & Conditions For NBP Advance Salary Loan Scheme 2024

1 National Bank of Pakistan is offering the lowest markup rates on their Advance salary loans from NBP i.e. 19.9% currently.

Two-Easy installments are offered to you at the time of your convenience (Maximum 60).

The 3-NBP advance salary loan is available through quick processing in comparison with other schemes for advance pay.

4. Remember that for NBP the advance salary scheme 2024, no required minimum wage, collateral, or insurance costs are needed.

5 Only permanent employees of the government, semi govt or autonomous institutions are eligible to apply for the NBP advanced salary schemes 2024. They are getting their salaries through NBP.

6-You are able to get a loan up to the amount of your 20 net take-home pay. This sum must not exceed greater than 2 million dollars.

7. The maximum period for loan repayment 7-The maximum tenure for repayment of a loan from NBP Advance Salary Finance is sixty months (Five years).

8- Your age limit at the point of maturity of the loan must not exceed sixty-nine years and six months.

9-Application processing fee of 2000 rupees or 2 percent of the loan amount, or whatever is greater.

10 You can get the form to apply for NBP’s Advance Salary Loan by clicking the link below.

Check NBP Advance Salary Loan Scheme 2024

NBP Advance Salary Loan Scheme 2024 Application Form

- Permanent employees that are paid via NBP can apply for

employees of semi-government and autonomous organizations can also make use of it based on their pay slips - The applicants are eligible to receive up to 20 wages from Advance and the largest amount for this kind of loan is now 200000.

- A need for minimum income, collateral, or insurance cost is required.

- The maximum length of NBP Advance Salary is five years.

- The applicant’s age isn’t greater than 60 and 6 months from the date of reaching the age of maturity.

- These loans are granted at a very low rate markup

- Anyone who has applied to this program for the second time will qualify to receive discounts, too.

NBP Advance Salary Markup Rate 2024

Get the Advance Salary Installer here. If you’re looking for more information on the interest rate marking up, go to this site: National Bank of Pakistan Branch. The NBP Advance Pay program permits you to claim up to $3,000,000 of the amount you be able to earn in the future.

NBP Advance Salary Installment Calculator

For Permanent Employees

NBP Advance Salary Installment Calculator

* Avail financing up to Rs. 3 million on your salary.

* The lowest mark-up rate is 25.5 percent fixed (per annum)

* Simple installments that can last up to 48 months at your discretion

For Contractual Employees

NBP Advance Salary Installment Calculator

* Avail financing up to Rs. 2 million on your salary.

* The lowest mark-up rate is 27 percent fixed (per annum)

Easy installments that can last up to 48 months at your discretion in accordance with the contract’s terms.

How to Apply for NBP Advance Salary Loan

The National Bank of Pakistan advance salary loan scheme 2024 has been launched recently and is available to you to apply following the procedure that has been laid out.

- The applicant can complete the NBP advance Salary Request for Loan Form using the hyperlink provided

- Once you have downloaded the application form, visit any branch at your institution to get more information.

- It is mandatory to submit the most recent 3-month pay invoice, CNIC photocopy, and two references. Certain requirements must be fulfilled for this lending program.

- Complete the application form together with the certification that you have been authorized to the branch which holds your account.

- Fill out the form and wait for confirmation from officials.

Contact Information

- Address: National Bank Of PakistanHead OfficeNBP Building, I.I. Chundrigar Road

Karachi, Pakistan. - Phone: +92 -21- 99220100 (30 Lines)

- Phone: +92 -21- 99062000 (60 Lines)

- NBP Call Center: 111-NBP-NBP (+92-21 111-627-627)

- SECP Investor Complaint Section

Http://Www.Secp.Gov.Pk/Complainform1.Asp

FAQs

What is the limit of advance salary in NBP?

How much is the upper amount for NBP advance Salary Loan? A. You are able to avail the maximum amount of the amount of Rs. 2,000,000/-, subject to debt burden requirement i.e. not exceeding 35% of the total disposable income.

What is the loan limit in NBP?

NBP Advance Salary FAQ – NBP. Avail financing up to Rs. 3 million on your salary. Avail financing upto Rs. 2 million on your salary. Simple installments of up to 48 months of your choice in accordance with the contract’s terms.

What are the benefits of NBP employees?

NBP offers high-paying salary packages for everyone working for the company. This includes Basic Pay house rent allowance utilities allowances, Medical Allowance, etc. Based on the performance appraisals, the salary increase is granted between 7% and 20% and in extreme circumstances, up to 30 to 30 percent.